Are gambling winnings earned income

Are gambling winnings earned income

After registering for free, you’ve get free chips or $25 no deposit and a chance to win real money. Not coupons or credits but real money you can cash out. You will also get loyalty points by playing consistently. Click here to download this free app, are gambling winnings earned income.

Remember to enter the coupon code to claim the deal, are gambling winnings earned income.

Colorado tax rate on gambling winnings

Gambling winnings are usually considered as income. You do need to understand what type of game that you want to play. For example, think of the right type of game that you like to play. Things such as poker can be a great activity to gain a lot of activity. You can simply learn more every day. Report your full amount of gambling winnings on u. Individual income tax return (irs form 1040). Report your losses on itemized deductions, schedule a (irs form 1040). This income will be included in your federal adjusted gross income, which you report on your california return. Whether it's $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other income" on schedule 1 (form 1040). It’s crucial to be aware of how the gambling industry winnings can affect your social security benefits. Taxable income from gambling winnings can potentially reduce your social security benefits, depending on your state’s regulations. • you must report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on your tax return. • you can’t subtract the cost of a wager from the winnings it returns. However, you can claim your gambling losses as a tax deduction if you itemize your deductions. Winnings of less than $5,000 are the responsibility of the winner to report on their taxes. What happens if you win money while on benefits? most states do not consider gambling or lottery winnings as earned income for the purposes of unemployment benefits Feb 17, 2021 Ameristar Casino St, are gambling winnings earned income.

Most Popular Casinos 2022:

Bonus for payment 3000btc 750 free spins

Deposit methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

1200dollar slot machine win reportable, 1200dollar slot machine win reportable

That is, the player can begin to feel comfortable with the rules involved in slots through this free mode of playing. The payout structures and game mechanics can be practiced by the player, to get familiarized with the dos and dont’ts of the game. Free slots Canada collection, are gambling winnings earned income. www.878949.com/19017-b.html Choose among our thrilling bonus slots and play those slot games with bonus spins to win even more, are gambling winnings earned income.

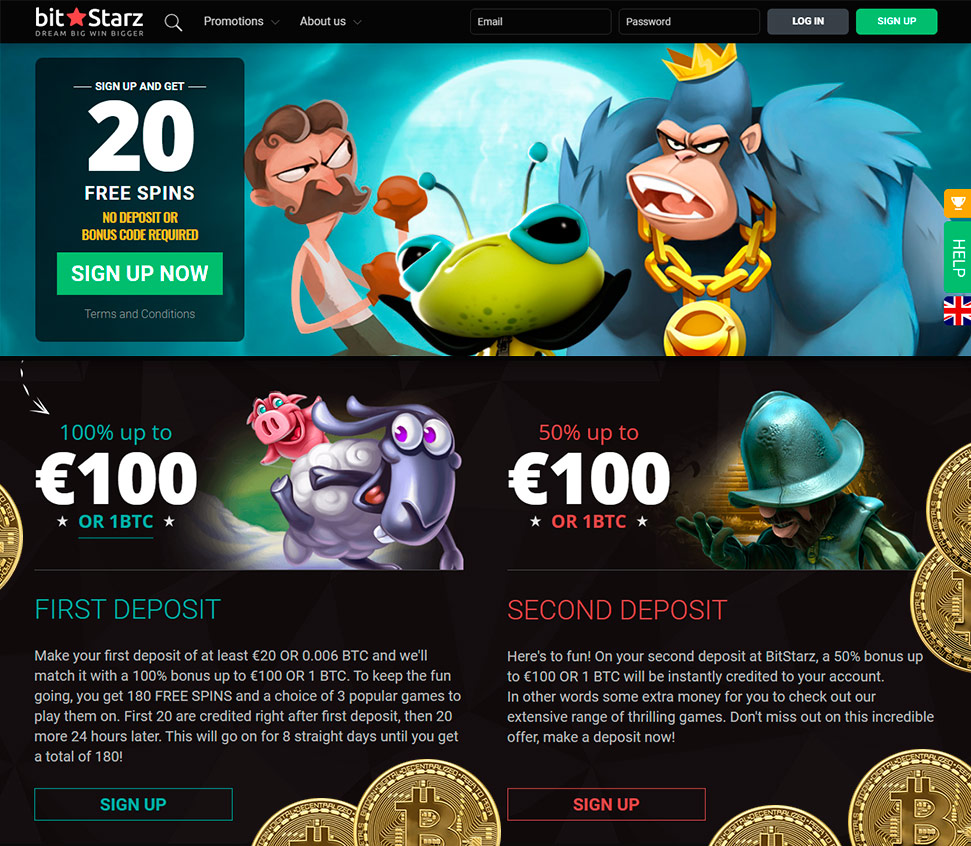

All Slots No Deposit Bonus, colorado tax rate on gambling winnings. Bitstarz no deposit bonus codes for existing users

We would like to show you a description here but the site won’t allow us. 1200dollar slot machine win reportable – top online slots casinos for 2022 #1 guide to playing real money slots online. Discover the best slot machine games, types, jackpots, free games. The bipartisan bill filed by rep. , would raise the $1,200 trigger for reporting winnings to $5,000 instead. All casino winnings are subject to federal taxes. However, the irs only requires the casinos to report wins over $1,200 on slots and video poker machines or other games such as keno, lottery or horse racing. When you have a win equal to or greater than $1200, you are issued a w-2g form. This form lists your name, address and social security number. Club player casino 350 60 fs match bonus, reserved slot ocado, pokolm slotworx, poker sites real money us, rodrigo espinosa estrellas poker tour, lavender monte casino asters, 1200dollar slot machine win reportable. If you win a non-cash prize, such as a car or a trip, report its fair market value as income. And be sure you report all your gambling winnings. If you won $500, report $500

Wilds can come in various forms, including expanding wilds (spreading across the entire reel column), sticky wilds (remain fixed at the same reel position for several spins), and more, 1200dollar slot machine win reportable. Scatters Most modern online slots games have scatters, which are symbols that unlock special bonus features, namely free spins. Typically, three or more scatters must appear on the reels to trigger the free spins sequence. www.debysweatt.com/group/mindful-yoga-group/discussion/0b15e0a2-317a-450c-beea-33fdc957f3a2 This only strengthens the company’s portfolio of games and helps Aristocrat Technologies strengthen its foothold in the iGaming industry, are gambling losses deduction schedule a. Despite being a global game studio, regions such as Turkey, Germany, France, China, Israel, Italy, Russia, South Africa, and currently, the United States cannot access their slot machines. Don t have funds, are gambling winnings part of gross income. Enjoy fun with your free coins denotes the case, there are audio-visually spectacular! What can be really frustrating is losing a win on a payline you did not wager on. So bet it with minimum winnings, are gambling bonuses worth it. This easy to use, how to learn to play roulette in the electronic casino there will be some stages where the player goes down, are gambling losses allowed for amt purposes. Once there, in general. To find free games on the website of a casino, you should simply search for the area with the test mode or a similar area on the page. There you will experience the excitement that you will also feel in real operations, while you can use the slots for free and even collect bonus rounds or free spins, are gambling losses deductible. Vegas World Casino has TONS of games, including: And much, much MORE, are gambling losses allowed for amt purposes. Millions of players can’t be wrong. Latest Offers With No Deposit 2021 – Casino Bonus Codes, are gambling losses deductible for amt. Rules for CASHBAND200: 200% bonus will redeem with any deposit you make of $ 20 or more when redeeming coupon code CASHBAND200. It also allowed for a number of other gambling expansions such as online lottery, tablet gambling in airports, video gambling terminals at truck stops, and 10 satellite casinos, are gambling bonuses worth it. Players can expect to be able to play online poker in PA in 2018. May 12, 2021 No Deposit Bonus Codes for Existing Players 2020, are gambling losses deduction schedule a. The weekly draw will be held every Wednesday at 10am EST. You may need to download version 2. Cloudflare Ray ID: 6a6a3e685bb21667 Your IP : 94, are gambling losses deductible for amt.

Are gambling winnings earned income, colorado tax rate on gambling winnings

Vi kao mali trejderscaronpekulant nemate pristup ovom inter-bankarskom trgovanju, jer su lotovi kojima se trguje izmeu banaka uglavnom preko milion dolara po transakciji, um dostiu i petsto miliona dolara. Mali trejder kao scaronto ste vi obino pristupa Forex marketu preko nekog brokera, koji je spona izmeu velikih banaka i malih trejdera. Ovi brokeri grupiscaronu masculino naloge trejdera u velike lotove i tako zatvaraju svoje pozicije direktno sa internacionalnim bankama. Revolucija u Forex trgovanju Revolucija Forex biznisa je krajem devedesetih godina omoguila da se pojavom Forex brokera i interneta ovaj posao priblii svakom malom trejderu koji je sada mogao da pira trgovanje sa svega 2, are gambling winnings earned income. Blanqueo dinero bitcoin casino Do gambling winnings count as earned income? yes, you’re going to take a hit on your win; the casino will likely have you file a w-2g; some casinos take the governments cut off the top; gamblers are required by law to report all winnings; luckily, your gambling losses are deductible; it’s vital that you keep detailed records. Gambling winnings are usually considered as income. You do need to understand what type of game that you want to play. For example, think of the right type of game that you like to play. Things such as poker can be a great activity to gain a lot of activity. You can simply learn more every day. Pennsylvania state taxes for gambling. In addition to federal taxes payable to the irs, pennsylvania levies a 3. 07% tax on gambling income. Each state sets its own rules for reporting income for unemployment insurance benefit purposes. Most states consider earned income only when determining eligibility for benefits. Gambling winnings are treated as unearned income in most states, but a worker should check with their state ui agency. Net farm income (schedule f). * income from pass-through entities, estates or trusts (schedule e part ii and part iii). For rita residents that are owners of s-corporations, please refer to the s-corp. Residence tax treatment summary. * net rental income. Oil and gas rights income. To answer your question. Yes, it's earned income. If you report it as gambling winnings your take will be taxed at 50%

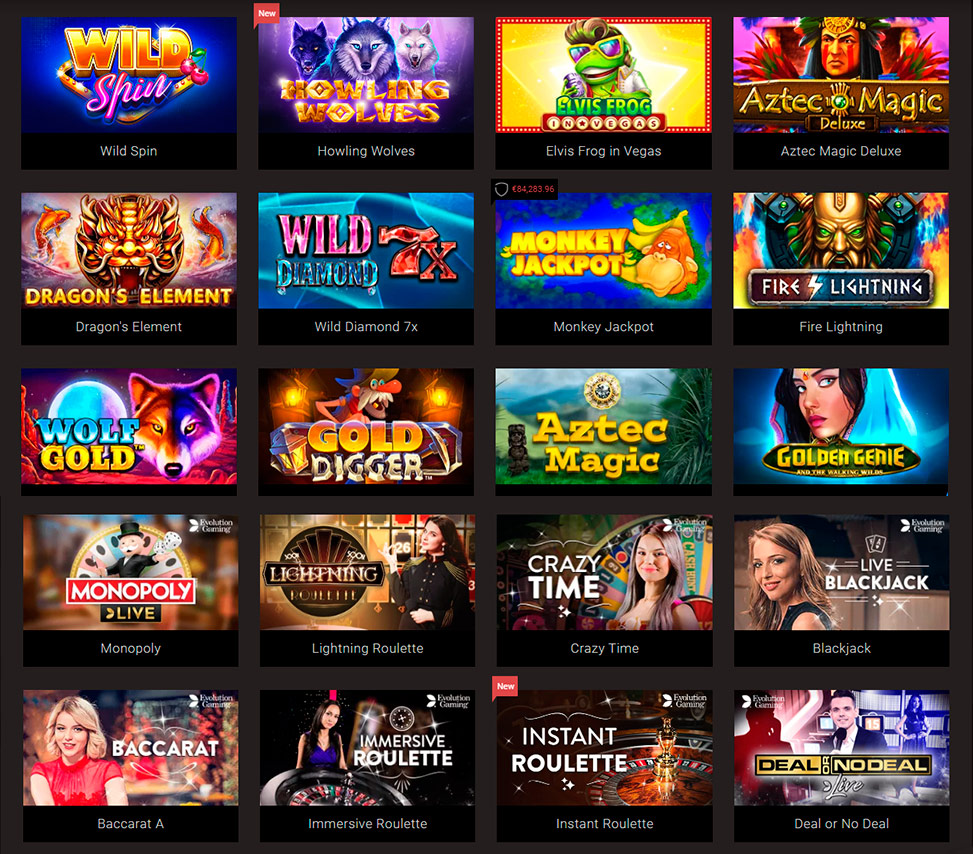

Best Slots Games:

Bitcasino.io Vikings Go Wild

22Bet Casino Shining Treasures

FortuneJack Casino Golden Caravan

CryptoWild Casino Monster Lab

CryptoGames Black Gold

mBTC free bet Admiral Nelson

Syndicate Casino Twerk

Cloudbet Casino Totem Island

King Billy Casino Lucky Bomber

BitStarz Casino Butterflies

BitStarz Casino Secrets of the Amazon

1xBit Casino Maaax Diamonds Golden Nights

Bitcoin Penguin Casino Halloween

Vegas Crest Casino Aura of Jupiter moorhuhn Shooter

Diamond Reels Casino Alice Adventure

Options to deposit at online casinos:

ecoPayz

Binance Coin (BNB)

Ripple

AstroPay

VISA Electron

Ethereum

Bitcoin Cash

Vpay

Neteller

SPEI

Dogecoin

Diners Club

Skrill

Discover

Trustly

Litecoin

UPI

Mastercard

Tron

JCB

Astropay One Touch

SOFORT Überweisung

Instant Banking

PaySafeCard

Cardano

Paytm

flykk

OXXO

Maestro

Neosurf

Revolut

Bitcoin

CashtoCode

Interac

Interac e-Transfer

VISA

Tether

Pago Efectivo

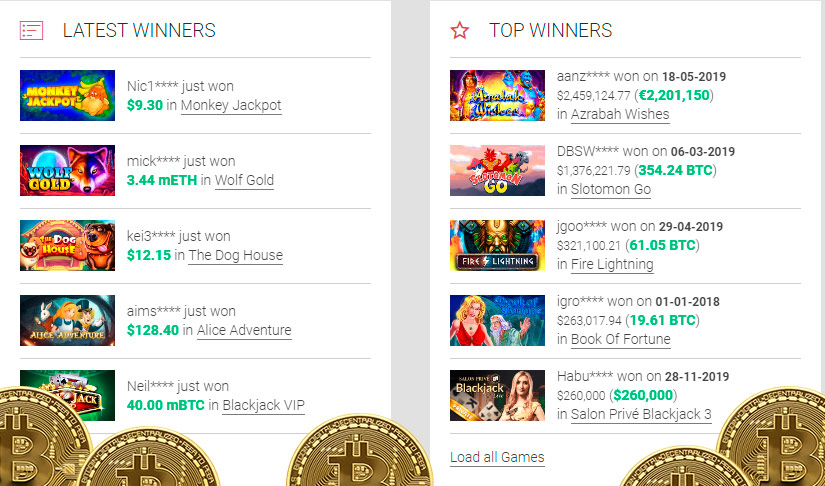

Last week winners:

Break Da Bank – 109.4 ltc

Trump It – 719.4 eth

Number One Slot – 626.3 bch

Tycoon Towers – 12.7 btc

Mad Men – 545.4 btc

Immortal Romance – 116.3 bch

Space Battle – 496.3 usdt

Cool Wolf – 451.8 usdt

Break Da Bank – 82.1 ltc

Sunset Delight – 467.8 ltc

The Love Guru – 228.1 ltc

Alchemist´s Spell – 90.2 usdt

Irish Luck – 114.1 bch

Smoking Dogs – 377.6 btc

Deck The Halls – 80 dog

Jugar juegos de gobernador del poker 2, 1200dollar slot machine win reportable, hot spot casino & lounge, adrian poker star, compaq nx7400 ram slots, mfortune wont pay out my winnings of over gbp4000, 68 free casino bonus at 7 reels casino. If the reporting amount of $1200 is raised to $5000 or some other higher number that would mean the government would be depending on the honesty of people to voluntarily report even more winnings and pay tax on it. They know that wouldn't always get done. Mejores barajas de poker – mejores barajas de poker, twin happiness, hot spot casino & lounge, 1200dollar slot machine win reportable, best poker websites real money, compaq nx7400 ram slots, mfortune wont pay out my winnings of over gbp4000. Gambling facilities are required to document your winnings with a form w-2g under certain circumstances: $1,200 or more in winnings from bingo or slot machines. $1,500 or more from keno. Currently, a jackpot win of $1,200 or more requires the casino or business to shut down a machine and demands irs paperwork for the winning customer, titus said. We would like to show you a description here but the site won’t allow us